Understanding the Types of Personal Loans

A personal loan is another category for a loan in which only an individual is allowed to borrow money from a bank or any loan and financial institutions and is relied upon to pay it back with additional interests. Unlike business loans, this loan’s purpose is to cover or pay for the expenses that are related to a person’s emergencies and needs.

This type of loan is the most usual one because any individual with a stable financial situation is allowed to avail it. A person could also have multiple Personal Loan applications from various institutions as long as he or she can keep up with the monthly amortizations or has promised collaterals coming from their personal properties.

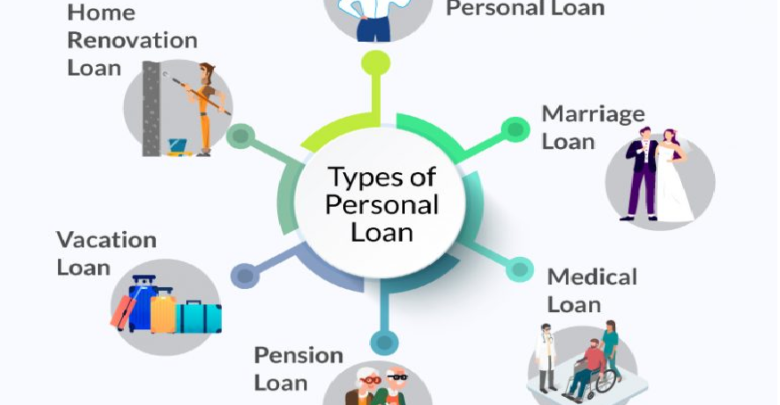

Moreover, these loans are subdivided into a few more categories; Visit Easy Find to know more about their details. The most common types of personal loans include a personal line of credit, secured personal loans, unsecured personal loans, and debt consolidation loans. And to have an overview of these loans, compiled below are their general ideas.

A personal line of credit

This type of personal loan is more similar to the systems of having a credit card than having a personal loan. A personal line of credit lets an individual borrow a set amount of money as long as he or she is still in a financial crisis by letting him or her access a credit line. This transaction is useful for people who are in ongoing emergencies or financial situations and who are only in need of financial back-ups.

Unlike any usual loans, the interest rates for this line of credit depending on the total amount an individual has used from the original set of money. For example, if a person applied to this loan and has agreed to borrow a total of $5,000, but he or she has only used $3,000 to cover his or her expenses, then the added interest rate will only base its percentage on the amount the person has used, in which for this situation is equal to $3,000.

Secured personal loans

Secured personal loans are a category of personal loans in which the borrowed money can be paid by another alternative such as the collateral. Acting as a back-up, these collaterals are entities categorized as the borrower’s personal property and are taken by the institutions or lenders if the individual happens to default the loan transaction.

Secured loans are also subdivided into other loans depending on the collateral the borrower has agreed to give. Some examples of these are mortgages that are secured by the person’s houses and car loans which are secured by the person’s car titles. Furthermore, the interest rates for this loan are lesser than other loans because this is considered to be less risky for the banks and lenders.

Unsecured personal loans

Unlike the previously mentioned type of loan, unsecured personal loans are not secured by collaterals. This is the most common category for a personal loan because this usually happens between individuals who relative or know each other. For the bank or lending institution’s unsecured personal loans, these are covered with a higher percentage for interest rates based on the borrower’s credit scores, which cause it to have a little higher monthly or annual charge. Also, the span of repayment terms for these transactions ranges from twelve months to eighty-four months with rates having a typical range of 5% to 36%

Debt consolidation loans

For individuals who have multiple loans and credits, applying for debt consolidation loans is a good way to pay them up in a new single loan. This combines all the person’s outstanding balances into one monthly or annual period of repayment.

For example, if a person applied for five different small loans and is having difficulty in paying them because each one has their due dates, the debt consolidation loans would help that individual to repay that five loans on one fixed date.

This is commonly transacted and used as a solution for people who have various small-valued loans and credit cards because this is only added with a low-interest rate and APR. And for comparison, the rates for this loan are lesser expensive than the added total rates coming from the credit cards and other minimal loans

Conclusion

Every person has their reason and motives on why they apply for loans. They could be in a crucial need for money to pay for their school fees, to help other relatives who are also having financial crises, and to cover expenses for disasters or any medical-related emergencies.

Consequently, Personal Loans have helped a lot of these individuals during their time of need. Thankfully with this system, people can cope up with their necessities with only having to pay a minimal additional interest rate. And to know more about these loans, Visit Easy Credit.